If you are looking to invest in house, you’ll likely get a land mortgage. Is everything you need to realize about home loans.

If you are considering investing homes, understanding the nuances out-of homes funds is essential. Away from qualifications standards toward all sorts of property financing available, you will find key factors so you’re able to browse before deciding. Whether you’re eyeing an article of raw home to grow out-of scrape otherwise considering improved parcels for the right commercial genuine estate funding place, the fresh new ins and outs away from homes fund can significantly impact disregard the. Thus, before taking the next step, it is required to learn the fresh new particulars of that it specialized financial support avenue and work out advised choice you to align with your homes acquisition wants.

To have informational aim simply. Constantly speak with a lawyer, taxation, otherwise monetary advisor in advance of proceeding that have people real estate deal.

Small Methods for Residential property Financing

- Land finance helps the purchase off domestic otherwise industrial residential property.

- Qualifications requirements were the very least credit score out of 720.

- Style of residential property financing become intense homes, unimproved property, and enhanced belongings fund.

- Residential property loans vary from structure fund in their objective and certification.

- Browse lenders for competitive pricing and terms and conditions tailored to homes acquisition.

What is actually a land Financing?

Therefore, you might be interested in homes loans? A secure financing, called much loan, try a financial unit that may help you pick bare property to have residential otherwise commercial invention.

These types of financing cater to some land models, off brutal land to completely build parcels, giving yet another path in order to property possession or increasing your company.

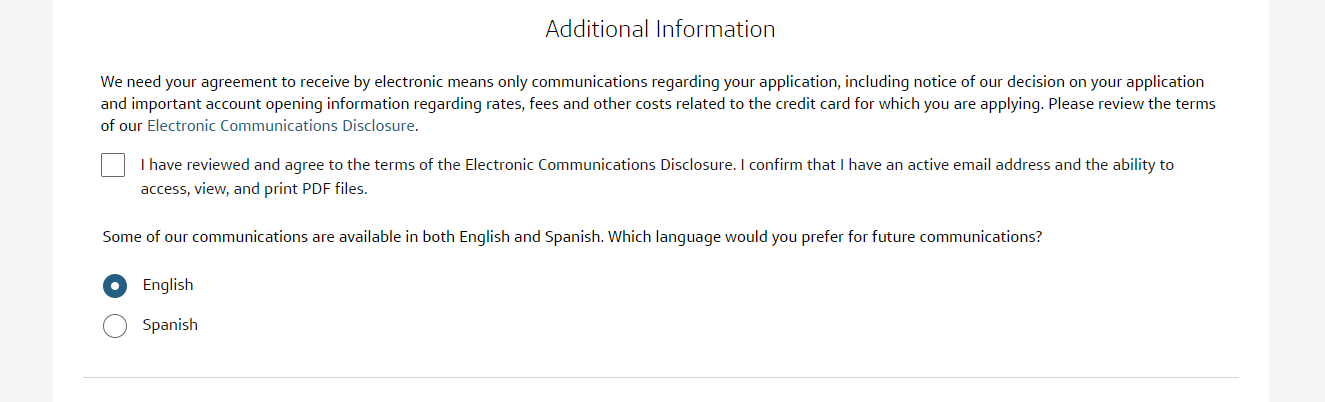

Residential property Loan Qualification Standards

A land mortgage, called that loan to own home buy, is actually created specifically to invest in homes purchase to own residential or industrial advancement. From inside the Tennessee, home loans offer customized words that have aggressive interest levels, allowing individuals to secure investment to own undeveloped, unimproved, otherwise increased property.

To be eligible for a secure financing for the Tennessee, lenders typically want a minimum credit history regarding 720 and down costs ranging from ten% so you can 50%, according to the type of home. Its necessary to search official loan providers and you will compare words to obtain the right fit for your land order need.

Version of Property Funds

In relation to property financing inside Tennessee, you have three primary options to pick: the fresh new Raw Belongings Financing, Unimproved Belongings Mortgage, and you may Improved Homes Financing.

Every type serves more home development stages, providing differing degrees of system and places. Facts such differences will allow you to select the most appropriate financing to suit your specific belongings purchase means.

Raw Homes Financing

Raw Home Finance bring financing having undeveloped belongings rather than amenities and normally require large down payments compared to other sorts of belongings funds. These types of fund is actually appropriate if you are looking to find vacant belongings to own future invention or recreational activities.

As brutal property does not have structure such resources or structures, lenders find it while the riskier, which the need for large down payments. Periodically you can aquire a house having a beneficial 5% advance payment, however, that isn’t one of them. When you’re these types of money give you the prospect of modification and you may building your fantasy possessions away from scrape, they may feature more strict qualification criteria.

It is required to has actually a strong plan for the fresh land’s future fool around with and you will creativity to provide in loan places Lazear order to loan providers whenever making an application for good intense property mortgage.

Unimproved Residential property Mortgage

Investing in unimproved homes compliment of a loan could offer solutions to own upcoming invention and you may leisure purposes, building through to the potential found in brutal belongings fund. Unimproved property finance typically safeguards parcels having very first tools however, lacking comprehensive system. These types of finance may need modest down costs and will act as a stepping stone between intense and you may improved belongings.