Co-applicant differs from co-signer for almost all reasons. Read on understand the difference between co-signer & co-candidate in detail here at IIFL loans.

Of many individuals, with inadequate earnings or no credit history, may have difficulty into the acquiring that loan. On these items, an alternate trusted private, generally from the members of the family otherwise certainly family, can advance and gives more guarantee to the financial you to the mortgage is paid back.

While you are default toward debt obligations can not be predicted, the problem are going to be quite minimized of the best comparison and you will borrowing risk government. Financing non-payments is scary to own loan providers and some one that happen to be guarantors so you’re able to finance.

That loan are yet another duty plus the guarantor must know there are dangers on it. Which, talking when it comes to accountability, it is very important understand the terms and conditions co-signer and you will co-candidate.

Given Co-Finalizing Otherwise Co-Using A corporate Loan?

With the knowledge that it’s the number 1 debtor who happen to be expenses back the mortgage and will be preserving the ownership of the advantage, co-finalizing will be a good clear idea. In case financial products and personal equations alter on prie due to the fact an excellent co-signer. Paying off brand new a great matter ‘s the just service offered. And, any overlooked fee by debtor often adversely impact the co-signer’s credit history.

Achievement

In a corporate the need for money is also arise anytime. Providing a relative otherwise a friend is great nonetheless it possess effects past a person’s expectation. Co-signing towards the another person’s team financing data is risky. However if there is certainly an excellent co-owner otherwise organization partner who is happy to split the duty out-of payment similarly, following co-credit is best. If defaulted, both parties is actually similarly in charge.

Always, a good co-signer try a friend or cherished one, with a good credit score and you will a strong income. Particularly anybody are going to be careful when you’re choosing to getting a great co-applicant otherwise a great co-signer. It is very necessary for an initial borrower in order to weighing both advantages and you can downsides and choose anywhere between a good co-applicant otherwise a beneficial co-signer.

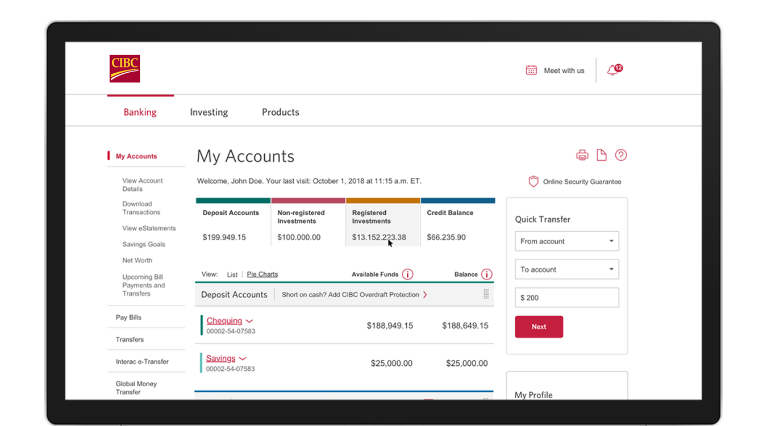

While the choice is created, it’s about time for a financial loan application. IIFL Funds now offers a number of loans to individuals and you may groups including a partnership corporation, individual limited company, an such like. People can use your website to make use of the brand new qualification calculator and be aware of the loan amount while obtaining a mutual team financing which have a co-applicant.

Sapna aapka. Company Mortgage Humara.

Disclaimer: Everything contained in this blog post is for general suggestions aim only. IIFL Loans Restricted (as well as their couples and you can associates) (“the business”) takes on no liability otherwise duty your errors or omissions inside the the brand new items in this particular article and you can for no reason will the Organization become responsible for people damage, loss, injury or dissatisfaction etcetera. sustained because of the any reader. All recommendations in this article emerges “as it is”, with no be certain that from completeness, accuracy, timeliness otherwise of show an such like. extracted from the usage this informative article, and you may in the place of promise of any kind, express or intended, as well as, not limited to guarantees off show, merchantability and exercise getting a specific mission. Because of the modifying characteristics regarding regulations, rules and regulations, there might be waits, omissions otherwise discrepancies about recommendations contained in this blog post. All the details about this blog post is given the newest knowing that the company isnt herein involved with leaving courtroom, bookkeeping, income tax, or other expert advice and properties. As such, it should not be used as a substitute getting visit having elite bookkeeping, income tax, judge or other skilled advisers. This post could possibly get have opinions and you may viewpoints which happen to be those of the latest experts and don’t necessarily reflect the official plan or condition of any almost every other department or organization. This short article may consist of backlinks to external websites that are not provided otherwise maintained by the or in in whatever way connected to the firm and Business doesn’t make sure the reliability, relevance, timeliness, or completeness of www.paydayloanalabama.com/auburn every details about this type of additional websites. Any/ the (Gold/ Personal/ Business) mortgage equipment demands and guidance you to definitely perhaps produced in this particular article try susceptible to change from time to time, website subscribers are advised to contact the company to have current specifications of the said (Gold/ Personal/ Business) mortgage.