- FHA Mortgage Limitations: Writing on the us Institution regarding Housing and Urban Invention the new restrict number you can borrow utilizes the price of houses for the a particular urban area. To have affordable components new restriction was $420,680 and for high rates parts the fresh restrict was $970,8000. So it varies by condition and county.

- Residential Use: FHA fund are only appropriate having qualities and will not end up being offered to help you funding otherwise trips features.

- FHA Review: Prior to being approved to possess a keen FHA financing a keen FHA appraiser commonly gauge the assets centered on a collection of defense recommendations.

There can be so much more criteria which can be additional of the loan providers towards the greatest of those you’ll need for an enthusiastic FHA mortgage, it’s important to check with multiple lenders to determine what financial will probably be your greatest fit.

Virtual assistant Finance | 580-620

Once the Virtual assistant claims its financing against losses, lenders bring Va funds at the low-rates of interest, most of the time these represent the lower rate of interest money offered.

Virtual assistant money and don’t require a downpayment which means mortgage will be 100% of the home price. In acquisition discover a good Va mortgage a certificate regarding Qualification (COE) becomes necessary.

USDA Funds | 620-640

USDA mortgages are around for belongings outside of heavily inhabited regions of the united states. Even though, USDA money are still appropriate to around ninety% of one’s end up in the us.

This consists of outlying elements, short locations, and several suburbs, however, conditions can be produced to possess homebuyers with extenuating situations. USDA financing instance Virtual assistant loans do not require a down-payment, as well as on mediocre the interest pricing are 0.5% less than traditional fund at one time.

Jumbo Money | 700+

Jumbo financing is actually for home buyers whoever mortgages are way too large into local mortgage limit. There is absolutely no specific credit history importance of a beneficial jumbo mortgage, however, higher score are more likely to become recognized.

Very lenders require a credit history out of 700+ to become eligible. Va Jumbo money are available at credit scores of 640 and you can above. To be assigned a reduced rate of interest it is preferable to count on wanting a rating on 700+ assortment.

Jumbo financing can be used for a variety of possessions models, and possess come useful number 1 residences, and additionally entertainment attributes such vacation house, or properties you to serve as an investment.

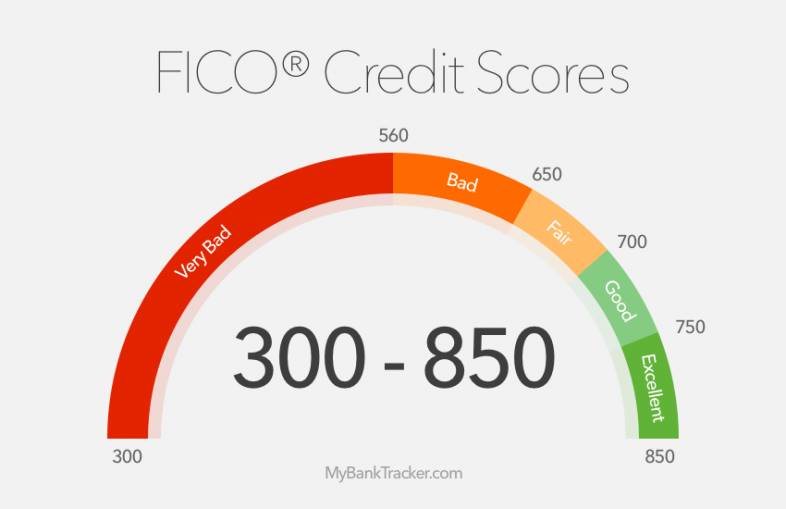

In the modern economy it. will be which you select oneself dropping short of the necessary borrowing or Fico score needed for a home loan. not most of the is not shed, you can go after specific guidelines that can outline just how to has actually the credit purchasing a house.

Compliment of following a number of points you could potentially improve your borrowing from the bank score by the quite a bit inside the a short span of your time. Several things which can help change your credit rating are: keepin constantly your balances toward playing cards low (significantly less than 29%), spending all expense promptly, and you can opening the newest account that declaration beneficially with the credit bureaus.

Following this you should allow your of good use profile adult for the a good standing, with enough time reputation for promptly fee records and you will in control utilize will receive your credit score boosting in no time.

- Financial obligation so you’re able to Income Proportion (DTI): So you’re able to estimate DTI sound right any monthly obligations payments and you will split the complete by gross amount of earnings you earn every month and multiply it by 100 getting a share. So you can be considered your DTI should be no larger than fifty% that have a great staying in installment loans in Houston DE the fresh forty%-45% range.